Childcare tax credit calculator

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. Ad No Matter What Your Tax Situation Is TurboTax Has You Covered.

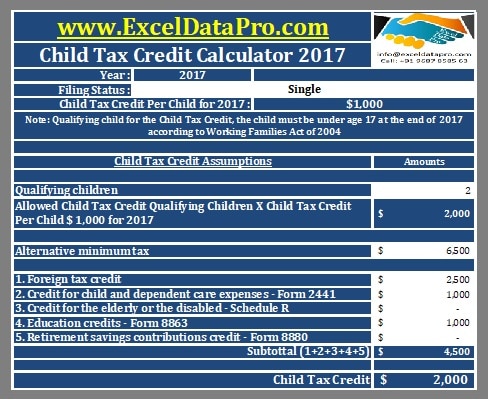

Download Child Tax Credit Calculator Excel Template Exceldatapro

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if.

. Write down the net expected income for coverage year or download and save the PDF. The maximum amount of qualified. Youth Services System Elm Grove Before After Care Program.

If you successfully apply for Tax-Free Childcare your Working Tax Credit or Child Tax Credit will stop. Up to 3000 per qualifying dependent child 17 or younger on Dec. Use the childcare calculator to work out which type of support is best for you.

This calculator determines the. Ad Free means free and IRS e-file is included. If the amount shown is.

Offering You Simple And Easy-To-Use Tools For Your Maximum Confidence This Tax Season. Max refund is guaranteed and 100 accurate. NC child support is calculated via a formula set by the Conference of Chief District Court Judges applying to couples with an annual income of 360000 or less.

Your Working Tax Credit or Child Tax Credit will stop straight away if you successfully apply for Tax. Use this calculator to find out how much you could get towards approved childcare including. Help with childcare costs if your child is under.

Use the childcare calculator to work out which type of support is best for you. The 2021 advance was 50 of your child tax credit with the rest on the next years return. When filling out your application youll be shown the expected yearly income.

Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes. The advance Child Tax Credit payments were signed into law as a part of the American Rescue Plan Act in 2021. The tool below is to only be used to help.

The newly passed New Jersey Child Tax Credit Program gives families with an income of 30000 or less a refundable 500 tax credit for each child under 6. The percentage depends on your adjusted gross income AGI. Up to 3600 per qualifying dependent child under 6 on Dec.

The Child and Dependent Care Tax Credit helps working families cover the high costs of child or dependent care so that parents are able to look for work and stay employed. For tax years through 2020 the Dependent Care Credit is 20 to 35 of qualified expenses. Have been a US.

The Salary Calculator for US Salary Tax Calculator 202223 - Federal and State Tax Calculations with full payroll deductions tax credits and allowances for 2022 and 2021 with detailed. For the 2021 tax year the child tax credit offers. Free childcare for children aged between 2 and 4.

Wheeling WV 26003 304 243. This child care center helps with children in the age range of 3 Years 0 Months - 6 Year.

What To Do If You Got An Incorrect Child Tax Credit Letter From The Irs

Child Care Tax Savings 2021 Curious And Calculated

I Made A Calculator To Help Parents Choose Between The Dc Fsa And The Dc Tax Credit For 2021 R Excel

What Are Marriage Penalties And Bonuses Tax Policy Center

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

Child Care Tax Credit Photos Free Royalty Free Stock Photos From Dreamstime

112 679 Tax Credit Stock Photos Pictures Royalty Free Images Istock

Child Tax Credit Enactments

Child Care Tax Savings 2021 Curious And Calculated

Download Child Tax Credit Calculator Excel Template Exceldatapro

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Try The Child Tax Credit Calculator For 2021 2022

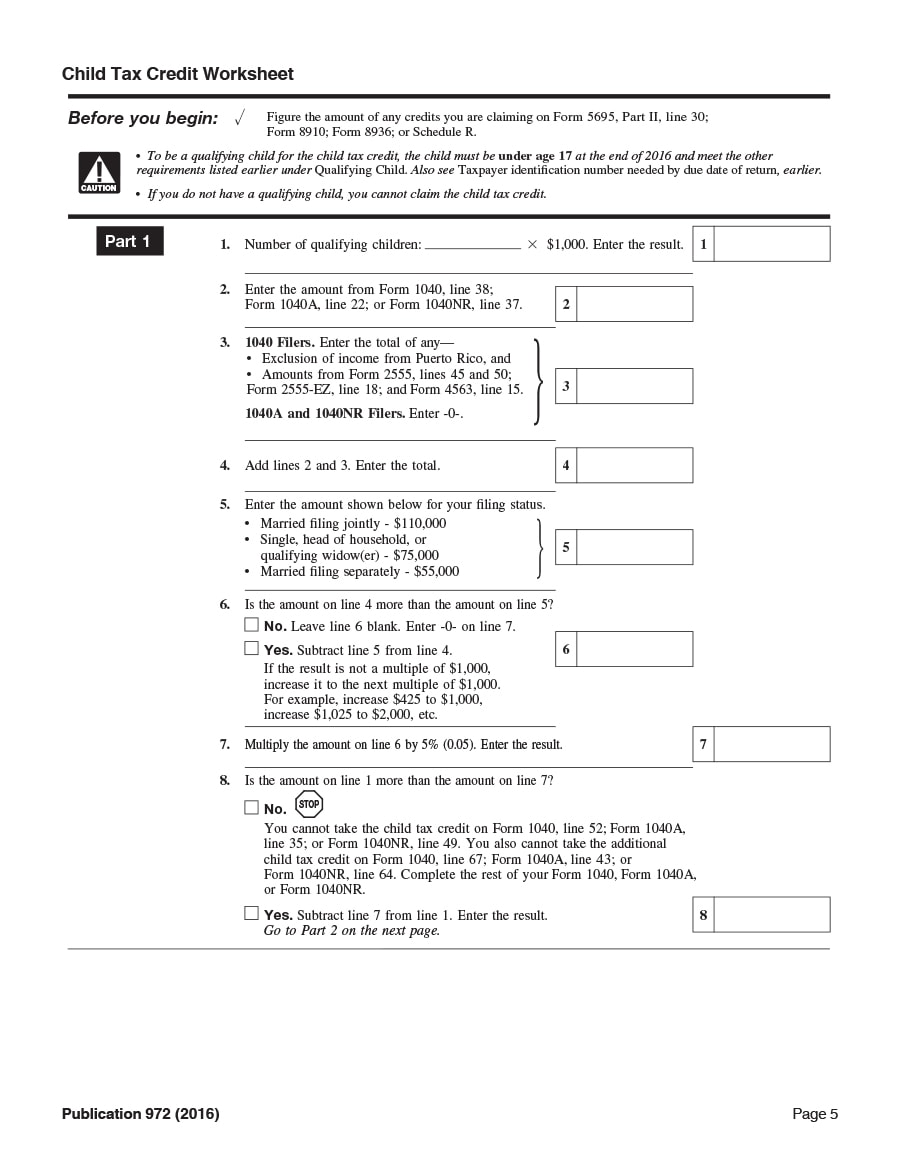

23 Latest Child Tax Credit Worksheets Calculators Froms

Download Child Tax Credit Calculator Excel Template Exceldatapro

Child Care Tax Credit Calculator Child Care Aware Of Nh

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

What Is Irs Form 2441

Obamacare Calculator Subsidies Tax Credits Cost Assistance